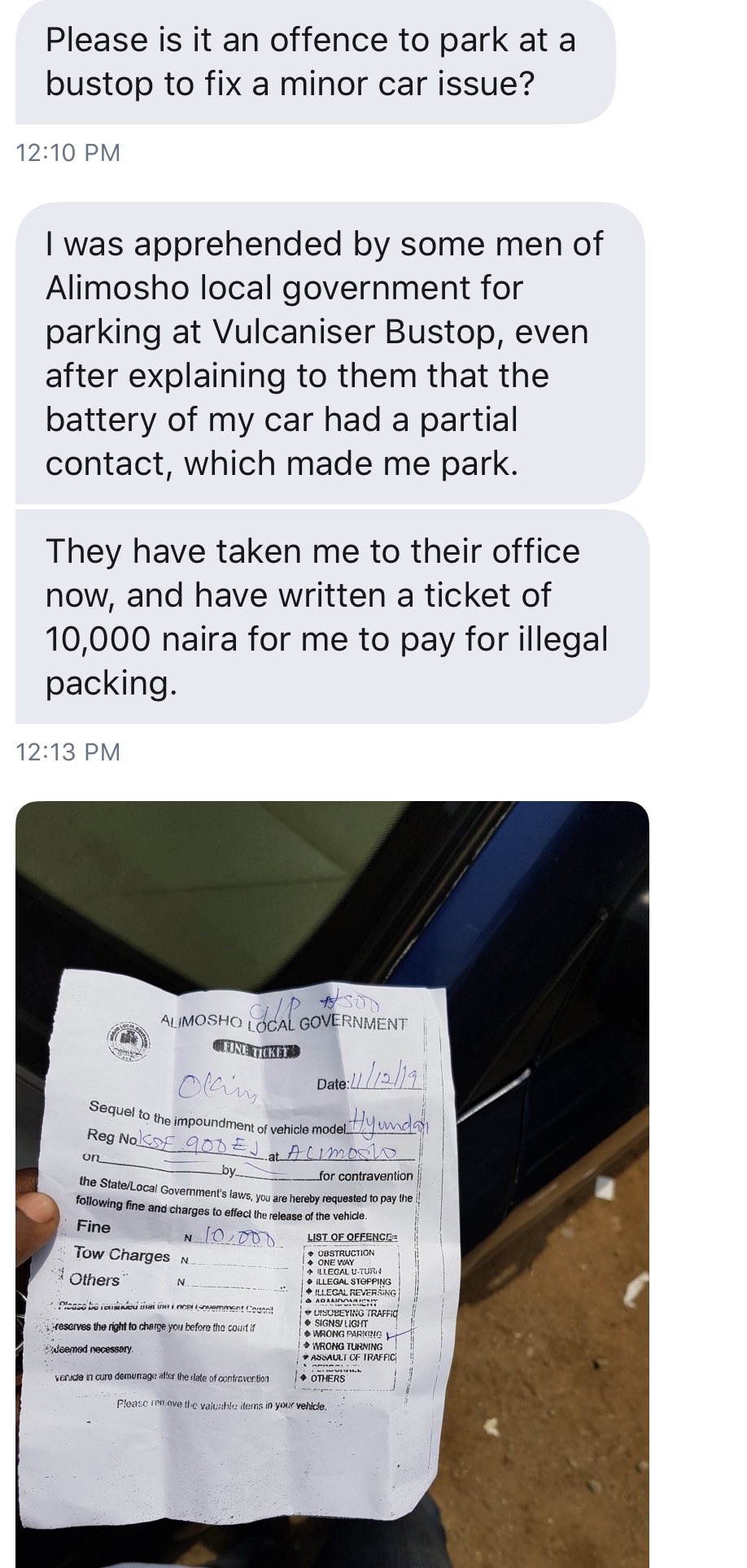

There are many illegalities that are going on in Nigeria that we let to go, not because they are right but because we are not enlightened enough to know our right as a citizen, the duties of the state, local and government agencies. Many at times, the local government agencies have turned themselves to god by milking the citizens dry not only that, most of what they are illegal.

According to the taxes and levy gazette act released in 1998, it states the type of taxes the three government arms are to government. Many at times, the local government guys have abuse their office and start doing the work of VIO and FRSC.

These are the authorized levies that the Federal Government of Nigeria approved in 1998 for Local Government, anyone charging you anything apart from this is a criminal.

Taxes and Levies to be collected by the Local Government

1. Shops and kiosks rates.

2. Tenement rates.

3. On and Off Liquor Licence fees.

4. Slaughter slab fees.

5. Marriage, birth and death registration fees.

6. Naming of Street registration fee, excluding any street in the State Capital.

7. Right of Occupancy fees on lands in rural areas, excluding those collectable by the Federal and State Governments.

8. Market taxes and levies excluding any market where State finance is involved.

9. Motor park levies.

10. Domestic animal licence fees.

11. Bicycle, truck. canoe, wheelbarrow and cart fees, other than a mechanically propelled truck.

12. Cattle tax payable by cattle farmers only.

13. Merriment and road closure levy.

14. Radio and television licence fees (other than radio and television transmitter).

15. Vehicle radio licence fees (to be imposed by the Local Government of the State in which the car is registered).

16. Wrong parking charges.

17. Public convenience, sewage and refuse disposal fees.

18. Customary burial ground permit fees.

19. Religious places establishment permit fees.

20. Signboard and Advertisement permit fees.

The only accepted fee they are empowered to tax is when you park wrongly, local government do not have the power to tax or bill you apart from that.

Many at times, we have fallen prey to the craftiness of these so-called officers that even when we are right but because we are not sure of what the law says, we have to part with our hard-earned money. One of the ways they tend to outsmart motorists is by quoting the wrong parking code which they quickly used to rob you in.

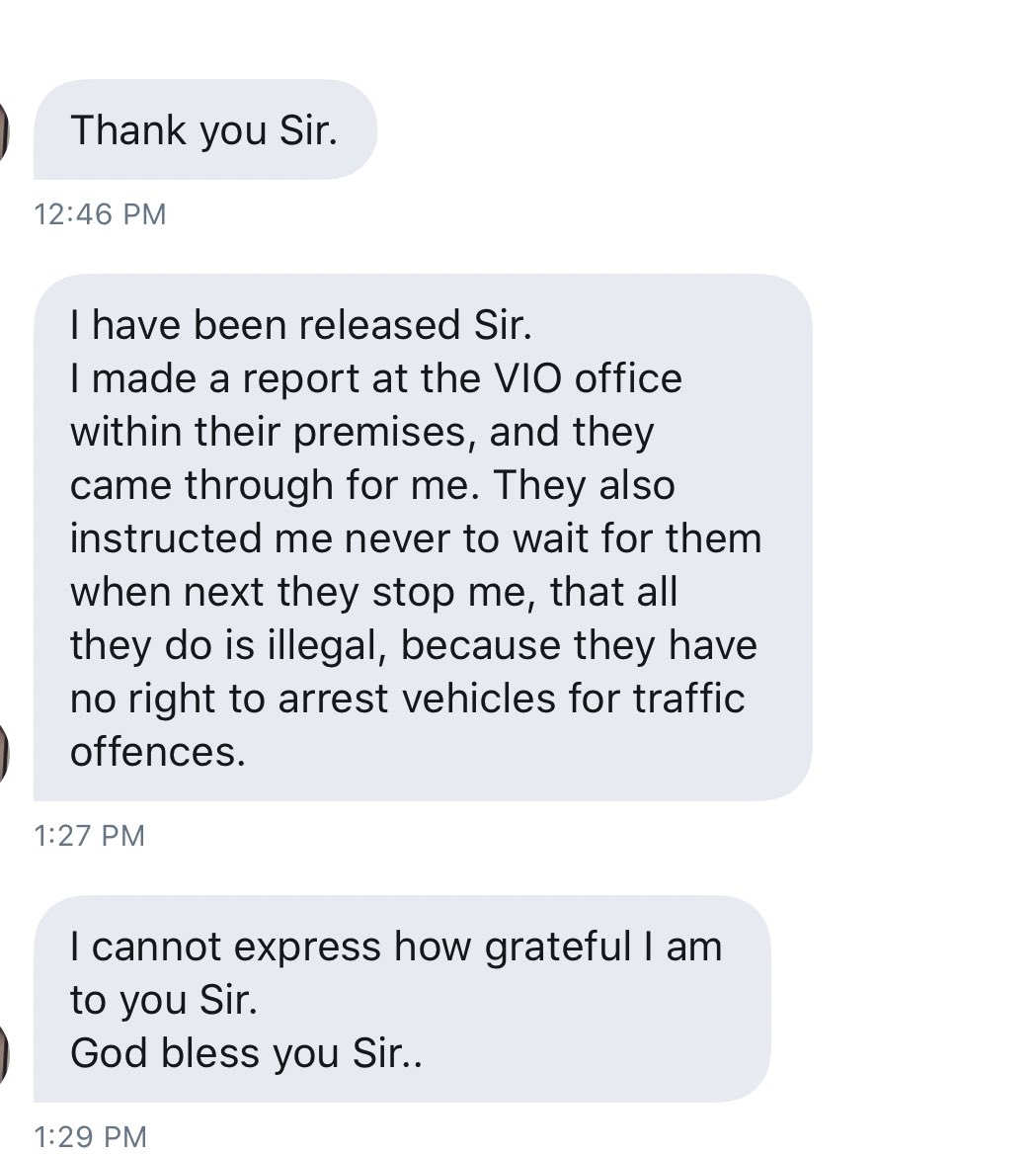

Please note, that you are not meant to pay a dime to any local government agencies, the only statutory bodies that can task, fine or impound your cars are the VIO and FRSC, even LASTMA is not empowered by law except if you break some certain rules that amount you to paying some fine.

Kindly take time to read through our initial post, The Duties and Functions of LASTMA, VIO and FRSC Officers.

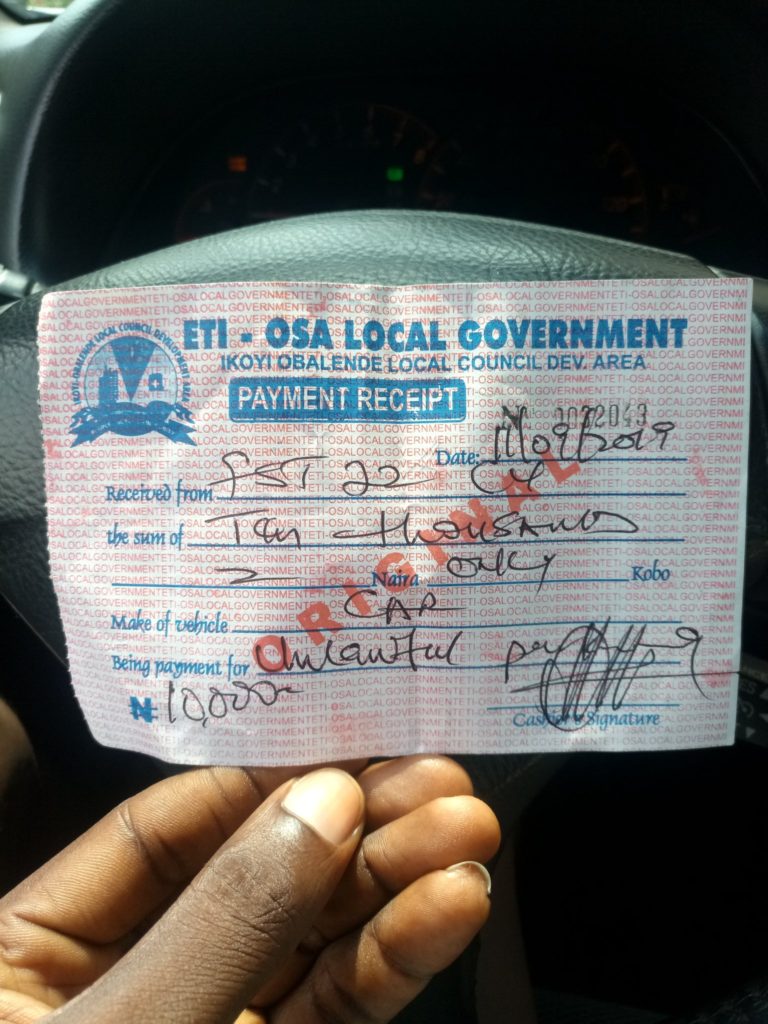

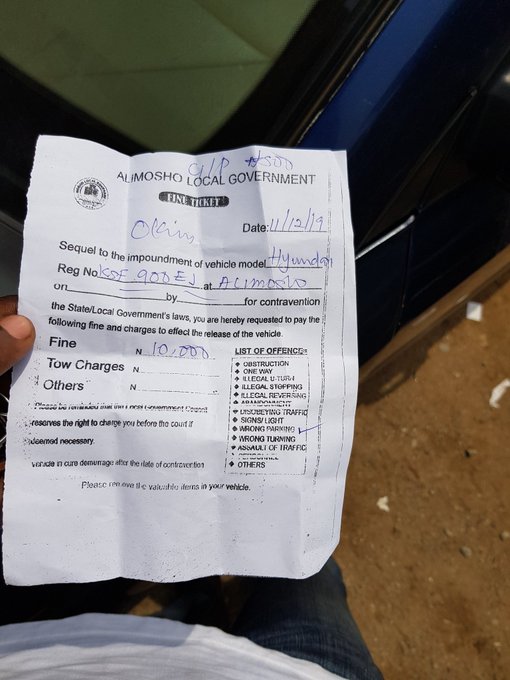

Meanwhile, these are some of the tickets that the Local Government officers are giving to their “customers”.

Don’t let the local government use you as a bait, be wise.

You must be logged in to post a comment Login